Mobile wallets: Replacing cash and swipe with a single phone tap

Mobile wallets take the help of near-field communication (NFC) chips inside smartphones and tablets to transmit payment information. Users can securely store their personal information in organized form on their smartphone. With the unprecedented rise in the use of smartphones, mobile wallets are also witnessing increased adoption across geographies. Some examples are Google Wallet, the Apple Pay, and Orange and Barclaycard, and Visa initiatives in the UK.

Mobile wallets take the help of near-field communication (NFC) chips inside smartphones and tablets to transmit payment information. Users can securely store their personal information in organized form on their smartphone. With the unprecedented rise in the use of smartphones, mobile wallets are also witnessing increased adoption across geographies. Some examples are Google Wallet, the Apple Pay, and Orange and Barclaycard, and Visa initiatives in the UK.

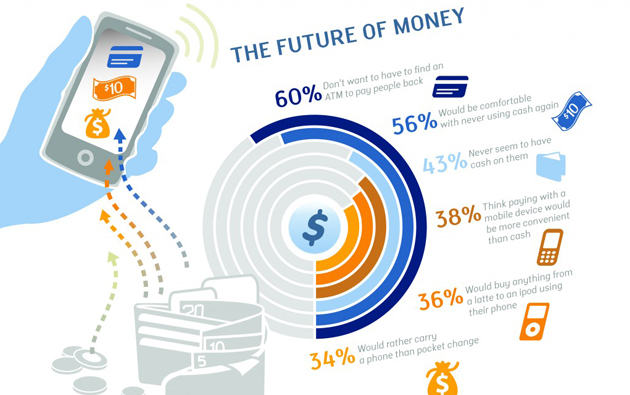

As per research on mobile wallets, mobile payments is expected to top USD 720 billion by 2017, from USD 235 billion in 2013. Tech companies are rapidly making moves to control the influx of bits and cash across several million smartphones across millions of online and physical locations. The increased adoption of these mobile wallets has led the perception of the platform to thereby change from being only a tool of payment to that of a customer engagement one. To cite an instance, Ebay’s PayPal division has upgraded its entire technology platform, and launched a complete new mobile payment app. In fact, it is pushing to place its Beacon sensors in millions of shops to augment the power of hands-free digital payments.

The other platforms, too, are not just watching. For example, Google has gone on board with some partners to build its market share in mobile wallets. AT & T, T-Mobile and Verizon would now pre-load Google’s app on certain mobile handsets. These companies have allowed Google to be in control of Softcard, the alliance they created to control their mobile payment destiny.

However, as per market research on mobile wallets, to understand what the future holds for online payment gateways, it is important to look at Starbucks. The mobile app of Starbucks is one of the most used digital payment apps in America. About 10 million customers are paying for their lattes with the app, making more than 5 million transactions per week. As per Starbuck’s Chief Digital Officer, Adam Brotman, this app has in fact enhanced the experience and relationship with the customer. On the other hand, cynics of this platform think that replacing credit cards and cash with a phone tap is just “technology for technology’s sake.” To ensure its growth, and for mobile money to really take off, it must offer more. PayPal President David Marcus thinks that the platform has to offer experience that consumers receive online today. He said, “You’ll get what you want really fast, pay really fast and get out. And the merchant will know more stuff about you, and that will make your experience better.” (How to Win the Mobile Wallet War)

While consumers look forward to speed through checkout lanes with mobile wallet payment, there are still things that need to be improved. Drawbacks like only enabling purchases from retailers with POS terminals, lack of royalty or reward programs from brands, or even safety concerns has led to slowing down of its adoption. To ensure its adoption by businesses and use by customers, mobile wallet platforms should integrate advanced analytics, and big data capabilities with robust security elements. Despite all these challenges, by 2018, the adoption of mobile wallets is expected to reach 15-20% of smartphone users. This is an impressive upgrade.

So, would you chose mobile wallet payment to make your next purchase?